source: tradingview

For the past few months, USD has been battered left and right. It weakened against almost all currencies. Well, mostly it was due to the FED. Nobody asked them to come out and gave a super optimistic rate hike forecast in 2016. They predicted they could do it 4 times. Well, obviously the markets did not take that well, sending the markets spiraling.

Then they got a little dovish in January. They said “they were weighing how the global economy and financial markets could affect the outlook”. But there was still hope for a March rate hike.

Then March came. They was a bunch of fed speak. Most of them seemed in favor of hiking the rates sooner than later. USD strengthened. But who would have thought it was being propped up for a bloody descent? The fed not only did not do any rate hike but instead they got so dovish that they could be fed sunflower seeds and kept in a cage. Ms. Yellen cut the forecast to two rate hikes and announced future rate hikes will be done gradually. She kept reiterating that term more than it was necessary. Naturally everyone got spooked and sold the USD like there was no tomorrow. But here was the twist. April meeting was apparently still “live”.

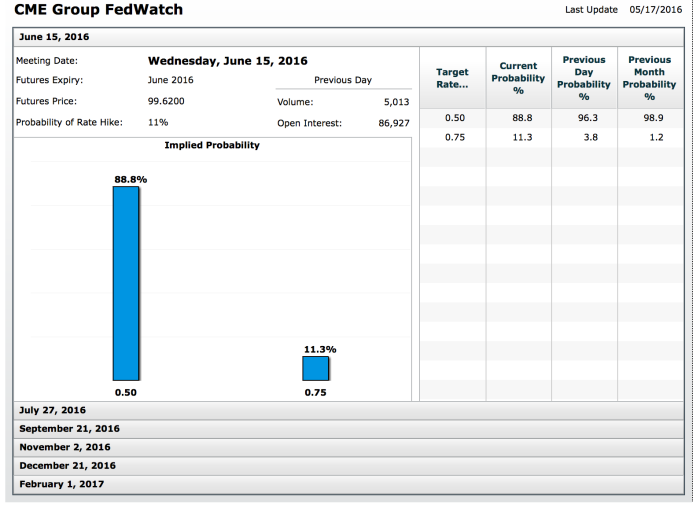

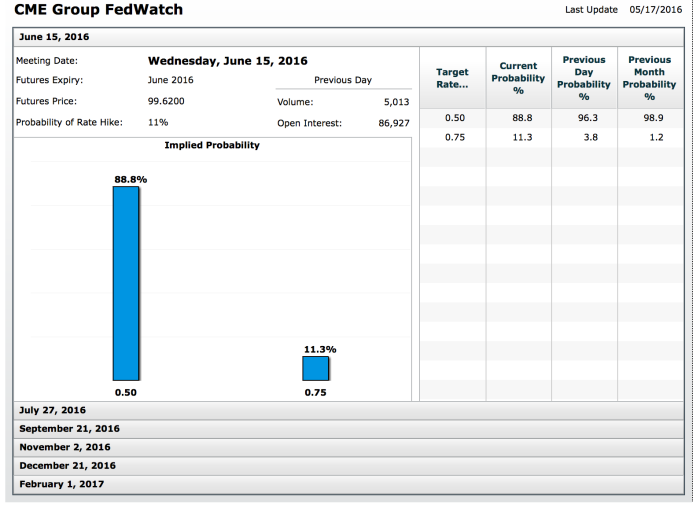

The whole world knew nothing was gonna happen in April as a strew of soft data came in, dousing any remaining flicker of hopes. The rate was unchanged in April as expected but the policy at least sounded more neutral. We are anticipating for the minutes of that meeting this Thursday at 2am. We are almost certain there would no rate hike in June with the impending Brexit referendum.

source: http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

source: http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

But would there be one in July? If there were any hints of such rate hike, USD will strengthen significantly against most currencies especially against Yen, given that Mr. Kuroda and Mr. Aso has been repeatedly warning to intervene or ease as soon as this June 16. This would be just few hours after the fed rate decision. Imagine if fed hint at hiking and Boj eased, the divergence itself could bring yen to 115 to 118 range.

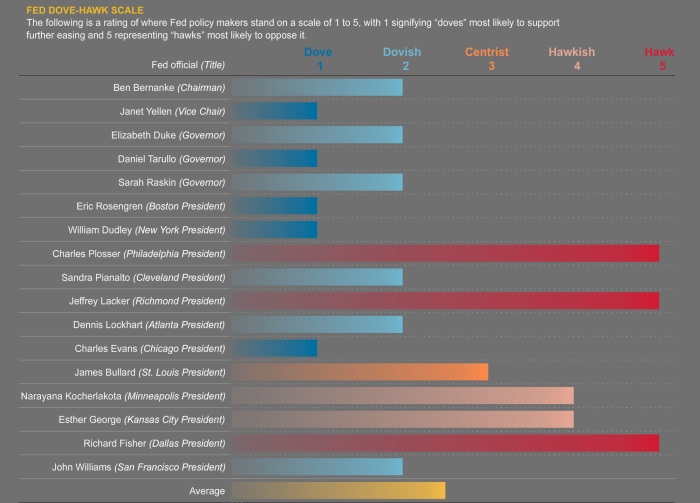

This is their general stance. So if they speak accordingly, usually there is not much volatility. But if instead they changed their views and speak rather the opposite, expect for big movements.

This is their general stance. So if they speak accordingly, usually there is not much volatility. But if instead they changed their views and speak rather the opposite, expect for big movements.

source:

source: