Market has been ranging quite tightly today since there are not any significant events on the calendar. For the time being at least, it is safe to say the market is moderately bullish on USD.

To round up for this week:

EUR/USD – Started off this week at 1.13 region but only to tumble down more than 1% after the relaease of the FOMC minutes. Their data has not been very helpful either. Euro’s strength was mainly due to USD’s weakness. Now that USD got its groove on, euro/usd is expected to slide further. For the time being, it has been hovering around 50% Fib level – 1.1214. The next support is at 60 – day MA 1.15, which was last hit on 28th March. I believe this would provide a strong support unless a significant event influences to break through.

USD/JPY – While Kuroda and Aso been taking turns to warn about their ability to ease further, USD has also finally chimed in with its hawkish FOMC minutes. Market has been really skeptical if BOJ can really do anything further but now with the prospect of FED’s interest rate hike, it has provided the market finally some incentive to sell yen. I believe this has eased some pressure from BOJ which has been criticized for its negative rate policy.

Yen has been depreciating throughout the week albeit gradually. Today is the start of the G7 meeting in Japan and yen should have been one of the crucial topic of conversation.I guess we would know further about it in Kuroda and Aso’s speech later in the afternoon today. It has steadily climbed from 108.5 to 110.5. The next resistance is at 111. Each time, it breaks a resistance figure, it retraces quite a bit before continuing its ascend so place take profits accordingly.

GBP/USD – Nowadays data of any sorts, save one or two crucial ones, does not seem to influence GBP at all. Its all about BREXIT. In the latest poll, there are more people wanting to remain in EU. That has skyrocketed GBP this week. Nevertheless, trading GBP is still risky amidst its weak data and looming brexit. Anything could go wrong from today till the referendum and thus, staying out of it is best.

USD/AUD – Remember the time when forecasts were coming out saying AUD could,would, should reach 0.80. And maybe, thats when RBA would ease.

Despite me having the benefit of the hindight, from the mid – March onwards, I believed the easing would have to come around May. And I took a long position in Aud/Usd but god, just my luck, Yellen had to come out and give the most dovish speech of all time. Aud climbed on the the back of a weak USD and rising oil prices. I was stuck in a dilemma for almost 2 months whether to stick with it or average it out. But when finally MAS, citing China, eased its monetary policy, I got the feeling RBA would follow suit and it did. But would RBA ease again. I highly doubt so. If US stays on track to hike twice this year, RBA may not move.

XAU/USD – Is the gold rally over? I dont think so. It might weaken substantially for the upcoming weeks till the rate hike but it would eventually appreciate during US elections, especially with Trump being a highly likely dude to become the next president.

To conclude, this week has been a pivotal one in FX market with USD appreciating against most currencies. Weakness in USD has caused a lot of volatility for the past few weeks, catching many of them off guard. Let’s see what happens next week!

That’s all for today and thank you.

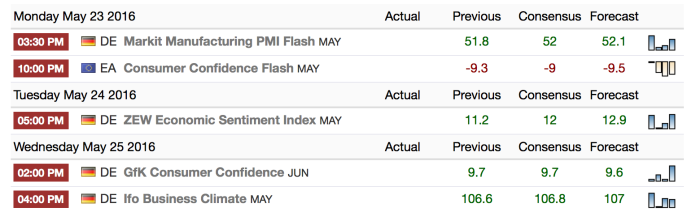

source: tradingeconomics

source: tradingeconomics

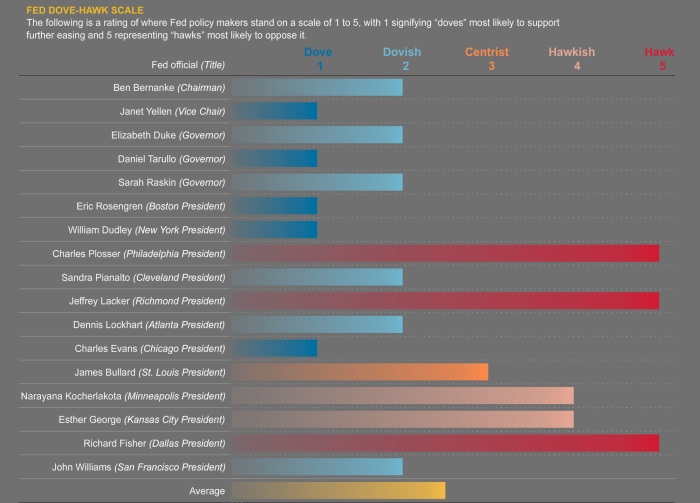

This is their general stance. So if they speak accordingly, usually there is not much volatility. But if instead they changed their views and speak rather the opposite, expect for big movements.

This is their general stance. So if they speak accordingly, usually there is not much volatility. But if instead they changed their views and speak rather the opposite, expect for big movements.

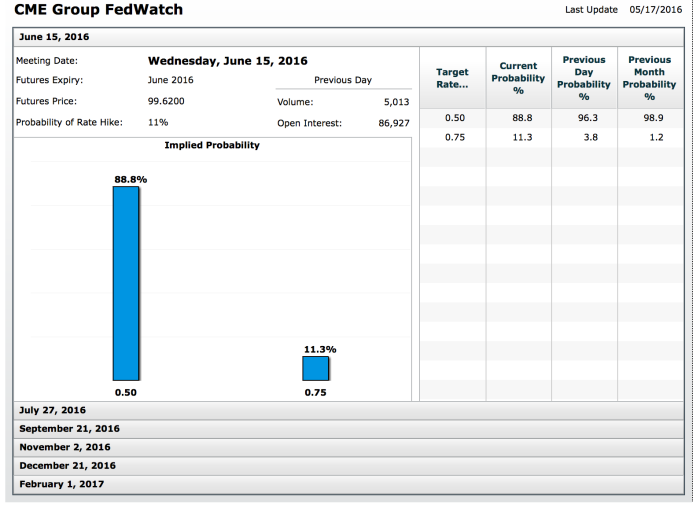

source:

source: